What is a “Cap Rate”?

Monday, November 7th, 2016

By: Steve Goldman, CCIM

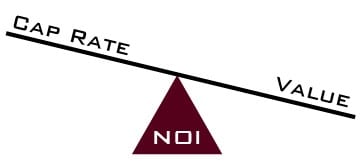

Capitalization Rate (or Cap Rate) represents the return on a property as if the investor paid all cash. It can be used to price a property or to evaluate the return on a property that has aready been priced.

The cap rate calculation uses net operating income (NOI) so non-operating expenses like principal, interest and depreciation are not included. A property with a $30,000/yr. NOI and a price of $300,000 would be priced at a 10% cap rate.

If rents were raised by $35,000 with no increase in expenses, the property would be worth $350,000 at the same cap rate. So a rent increase is very powerful. A 10x increase on a 10 cap and a 12.5x increase on a typical 8 cap apartment. This is why buying a property at a low cap rate but with rent increase potential can be smart!

Currently, we see triple net properties such as new construction Dollar General stores selling in a cap rate range of 6.25-6.40%. Apartments in Knoxville, depending on many factors, can range from a 6% cap rate for large newer properties; to 7-9% cap rates for the older and smaller properties.

Back to Blog